You can find the PDF version of the letter here.

As representatives of the digital financial services industry, we welcome the European Commission’s ambition to make instant payments the norm across the European Union via the Instant Payments Regulation (IPR). We hope this ambition is maintained throughout the interinstitutional negotiations. However, we would like to draw your attention to our concerns regarding electronic money institutions (EMIs) and payment institutions (PIs).

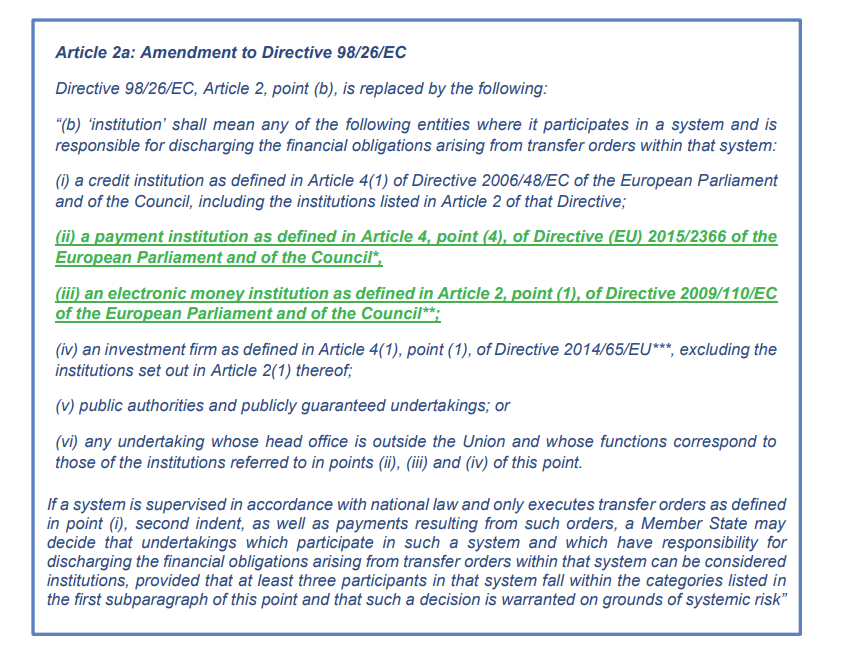

While the proposal is overwhelmingly positive and can offer a range of benefits to European merchantsand consumers, we regret to observe that the proposal exempts EMIs and PIs from the requirement to offer instant payments due to the existing legal barriers preventing them from directly accessing payment systems. This legal barrier put in place by the Settlement Finality Directive (SFD), Article2(a), excludes PIs and EMIs as potential participants in the designated payment systems, preventing these firms from offering instant payments directly. Infact, this barrier results in unequal access to payment systems, primarily allowing access to credit institutions, which, through commercial agreements,provide indirect access to those payment providers that cannot connect directly. Consequently, banks – often competing in the same markets as EMIs orPIs – are free to make commercial decisions if and how they provide this service to EMIs and PIs and can specifically charge them on a per-transaction basis well over the wholesale cost whilst gaining insight into their business performance.

We strongly support the European Parliament’s acknowledgment of the issue in recital 9 of their report followed by a proposal to amend Article 2, point (b) of the SFD. We hope the Council will adopt a similar approach and encourage Member States to go beyond an acknowledgment to propose concrete action to resolve the issue within the IPR.

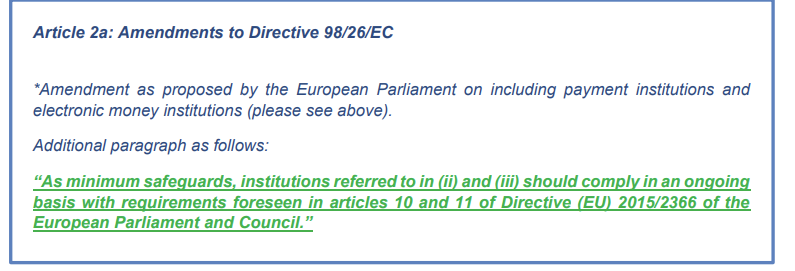

We agree with the compromise proposed by the Spanish Presidency, which would approve the above amendment by the Parliament while introducing minimum safeguards for accessing the payments systems by entities that do not have capital requirements. We emphasize that these safeguards must be proportional to the payment providers’ business models and related risks. While both banks and non-banks face identical operational cyber risks, warranting similar rules and robust IT security. However, PIs and EMIs encounter distinct risks due to their non-deposit-taking, non-credit-lending nature. Non-bank PSPs are generally safer in terms of liquidity, as client funds are held in safeguarded bank accounts. Nevertheless, each time when non-bank PSP seek direct access, they undergo a rigorous risk assessment, similar to banks, ensuring effective risk management for potential operational, legal, financial, and technical risks. Payment system operators would remain the gatekeepers, setting fair rules and requirements in their systems, reflecting the distinct business models and risk profiles of EMIs and PIs compared to banks. The advantages of granting non-bank PSPs direct access to designated payment systems within the EU far exceed the potential risks. It’s time for EU legislators and European central banks to foster a level playing field and promote fair competition.

We would like to mention that the European Commission’s proposal for PSD3 explicitly includes the amendment of the SFD, with additional clarifications on admission and risk assessment procedures. This is based on a targeted consultation which was completed in the first half of 2021 and shows that in substance the Commission favors the direct access to settlement systems by EMI and PI. The only difference being the timing of the implementation. We would like to express our deep concern that if the SFD is not amended alongside the IPR, but instead in the context of the Payments Package, it will take years for the barriers to be lifted, lengthening the unequal conditions in the European payments market. Furthermore, the status quo of the outdated SFD inhibits innovative European payment companies from accessing the necessary infrastructure, thus also preventing participation in European projects such as instant payments and the future digital euro (thereby necessitating reliance on foreign card networks that operate differently). While this question may seem technical, it has significant implications for the development of Europe’s payment market and overall for Europe’s strategic autonomy and sovereignty. Making sure that innovative European payment companies can play a full role in these projects alongside traditional banks is crucial for the uptake of instant payments, for the competitive strength of Europe’s market, and for consumers and merchants that rely on the services of these firms today.

It is worth noting that across several jurisdictions the decision to enable direct access resulted in significant innovation, improved consumers’ choice, providing them with significant transaction cost and speed benefits. Furthermore, countries such as Brazil, Singapore, Hungary, and the UK, that have successfully opened their payments infrastructure to nonbanks have not reported any increased risk to their payment systems.

The European digital financial service industry is convinced that to prevent delays in the application of the IPR, and to accelerate the roll-out of instant payments in the EU, the legal barriers preventing EMIs and PIs from directly accessing the payment systems should be lifted at first instance, before the IPR enters its implementation phase.

This is particularly important considering that the upcoming European elections in May 2024 and the end of the Commission’s mandate could negatively impact the timelines. While we appreciate that the Commission’s proposal for a Payment Services Regulation (PSR) sets out additional details to enable access to payment systems, we believe that removing the legal blocker in the SFD is best placed in the IPR. The Payments Package can then further reflect changes to ensure all Directives and Regulations are aligned. We believe that this is feasible as the Payment Systems Operators (PSOs) still remain responsible for setting their own access criteria, as these are not set out in the Payments Package.

Lastly, we firmly believe that the overall roll-out of instant payments can and needs to be done at pace, according to the feasible and realistic implementation timelines proposed by the Article 2a: Amendments to Directive 98/26/EC *Amendment as proposed by the European Parliament on including payment institutions and electronic money institutions (please see above). Additional paragraph as follows: “As minimum safeguards, institutions referred to in (ii) and (iii) should comply in an ongoing basis with requirements foreseen in articles 10 and 11 of Directive (EU) 2015/2366 of the European Parliament and Council.” Commission and Parliament (6 months for receiving and 12 months for sending instant transfers). The SFD amendments’ implementation timeline should align with these timeframes, preferably within 6 months after the regulation comes into effect. It is important to pursue the rollout of instant payments and the digital euro in the right competitive environment, from the start. Otherwise, we risk missing this window to shift Europe’s payment market onto a truly European footing. Without extending the scope of the SFD within this trilogue the chances of a successful introduction of new payment methods based on instant payments will be severely challenged.

We would be most grateful if you could take into consideration our concerns during the trilogue

negotiations and remain at your disposal to provide further clarifications.

Yours faithfully,

European Fintech Association, European Payment Institution Federation, European Digital Finance Association, Open Finance Association