Joint Industry Statement on AI Definition

In the wake of the December 2023 political agreement on Artificial Intelligence regulations, financial industry representatives stress the need to safeguard ongoing credit scoring operations from potential disruptions caused by pending technical details around the agreed definition of “artificial intelligence systems”.

Credit scoring is a vital element of the financial sector, providing a way to evaluate an individual’s creditworthiness based on their financial history and behaviour. This evaluation assists lenders in making well-informed decisions about extending credit or loans

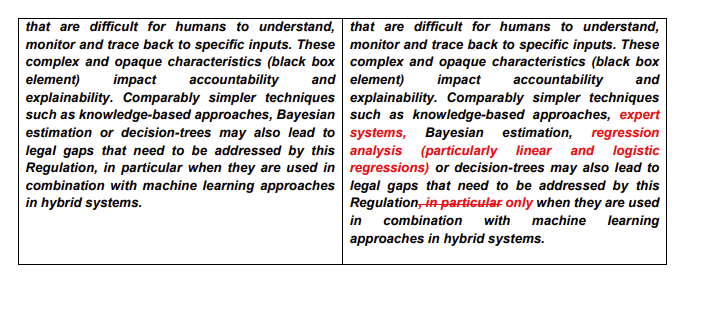

It is important to understand that creditworthiness assessments rely on credit scores, predominantly crafted using traditional and straightforward statistical techniques, including logistic regression, and decision trees, among others. These statistical techniques, utilised and effectively supervised for decades in credit scoring, are rule-based, using predefined algorithms. They lack the dynamic learning capabilities associated with true artificial intelligence and are designed to be transparent and explainable.

Traditional credit scoring techniques stand apart from artificial intelligence for distinct reasons:

- Rule-Based Processing: Traditional techniques follow predetermined rules and algorithms without

continuous learning or adaptation, unlike AI’s evolving performance.

- Limited Autonomy: Traditional techniques lack the autonomy and self-modification seen in AI; they

operate within predefined parameters set by human programmers. - Transparency: Traditional techniques are generally transparent and explainable, allowing clear

understanding and auditability, in contrast to the often criticized black-box nature of AI models,

especially deep learning ones.

It is crucial not to label these traditional techniques as artificial intelligence when used in isolation. Recognising this distinction is vital for ensuring a healthy, sustainable and vibrant financial services sector that benefits consumers while offering them a high level of protection of their fundamental rights.

To ensure legal clarity and distinguish between AI and traditional techniques, it is therefore imperative to

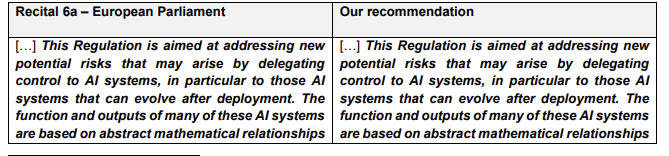

introduce clarifications within relevant recitals of the AI Act. A noteworthy example is Recital 6a of the European Parliament, which we believe can effectively contribute to achieving this objective. Taking these steps will contribute to a more precise understanding of the technologies shaping the financial landscape.

About ACCIS

ACCIS is the voice of organisations responsibly managing data to assess the financial credibility of consumers and businesses. Established as an association in 1990, ACCIS brings together more than 40 members from countries all over Europe, that have a consolidated turnover of around EUR 3 billion and close to 13.000 employees.

About the EACB

The European Association of Co-operative Banks (EACB) is the voice of cooperative banks in Europe. It represents, promotes, and defends the common interests of its 27 member institutions in banking as well as cooperative legislation. With 2,700 banks and 36,500 branches, cooperative banks are widely established across the European Union and play a vital role in its financial and economic system. They have a longstanding tradition serving their 225 million customers, mainly consumers, retailers, and communities. An important task of the EACB is to raise awareness on the unique characteristics of the cooperative business model: democracy, transparency, and proximity. In Europe, cooperative banks represent 89 million members, providing employment to 712,000 individuals and maintaining an average market share of approximately 20%. Website: www.eacb.coop

About EBF

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations from across Europe. The federation is committed to a thriving European economy that is underpinned by a stable, secure, and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere.

www.ebf.eu @EBFeu

About EFA

The European FinTech Association (EFA) is a not-for-profit organization representing leading FinTech companies of all sizes from across the EU. It brings together a diverse group of 35+ FinTech providers ranging from payments, to lending, banking, robo-advice, investment as well as software-as-a-service for the finance sector, with a clear focus on enabling a single market for digital financial services. For more

information, visit www.eufintechs.com

About ESBG

ESBG is an association that represents the locally focused European banking sector, helping savings and retail banks in 20 European countries strengthen their unique approach that focuses on providing service to local communities and boosting SMEs. An advocate for a proportionate approach to banking rules, ESBG unites at EU level some 885 banks, which together employ 656,000 people driven to innovate at 48,900 outlets. ESBG members have total assets of €5.3 trillion, provide €1 trillion billion in corporate loans, including SMEs, and serve 163 million Europeans seeking retail banking services. ESBG members commit to further unleash the promise of sustainable, responsible 21st century banking. Learn more at www.wsbi-esbg.org

About Eurofinas

Eurofinas, the European Federation of Finance House Associations, is the voice of specialised consumer credit providers in Europe. As a Federation, Eurofinas brings together associations throughout Europe that represent finance houses, specialised banks, captive finance companies of car, equipment, etc. manufacturers and universal banks. The scope of products covered by Eurofinas members includes all

forms of consumer credit products such as personal loans, point of sale credit, credit cards and store cards. Consumer credit facilitates access to assets and services as diverse as cars, education, furniture, electronic appliances, etc. Eurofinas members financed around €501 billion worth of new loans during 2022 with outstanding portfolio amounting €1.2 trillion euros at the end of the year.More information on Eurofinas activities available at www.eurofinas.org

About Leaseurope

Leaseurope brings together 44 member associations representing the leasing, long term and/or short term au-tomotive rental industries in the 31 European countries in which they are present. The scope of products covered by Leaseurope members’ ranges from hire purchase and finance leases to operating leases of all asset categories (automotive, equipment, machinery, ICT and real estate). It also includes the short-term rental of cars, vans and trucks. It is estimated that Leaseurope represents around 91% of the European leasing market. More information at www.leaseurope.org