Brussels, January 31, 2024: Following up on the joint EU fintech industry statement issued on May 17, 2023 (see here), ETPPA, together with EMA, EPIF, EFA and OFA, are calling on the co-legislators and the European Commission to clarify the compromise text reached on recital 34 of the AML Regulation in the technical trilogues; this in order to ensure that the text does not kill European payment initiation services (PIS). In summary, we see

- Inequitable treatment of PISPs compared to card acquirers

- Homegrown EU fintechs to be left at serious and unwarranted competitive disadvantage

- EU legislators urged to clarify Recital 34 so that PISPs’ CDD obligation relate only to merchants

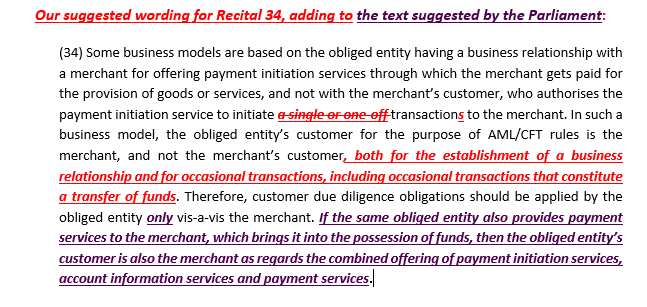

It is our view that the current draft compromise text for recital 34 needs to be further clarified in two crucial respects, and as we explain below, we are confident this can be done within the realm of the already existing political agreement. Otherwise, it will be impossible for European PISPs to compete with other payment solutions such as card acquirers (Visa/Mastercard), ApplePay and Ideal/EPI, all of whom have to perform due diligence only on the merchant to whom they provide services.

1) Clarification required

A user of PIS never has an account or balance with the PISP, but the PISP merely initiates a payment from the user’s existing bank account. This is similar to how cards, ApplePay, GooglePay, Ideal/EPI, etc. work. In all of these cases, the acquirer, i.e. the provider of the service to the merchant has an obligation to perform CDD on their customer, the merchant, but never on the payer.

It is our understanding that the intention of Recital 34 has always been to clarify that a PISP’s CDD obligations are vis-a-vis the merchant only, not the payer, i.e. to allow European PISPs to compete on a level playing field. The compromise wording however is not clear about this and leaves room for various interpretations, including one where also the payer could come into the scope of CDD if the payer uses the services of a PISP multiple times. To be clear, payers never get into the CDD scope of e.g. a card acquirer, independently of how many times they use such services or what amounts they pay.

It is our understanding that the intention of Recital 34 has always been to clarify that a PISP’s CDD obligations are vis-a-vis the merchant only, not the payer, i.e. to allow European PISPs to compete on a level playing field. The compromise wording however is not clear about this and leaves room for various interpretations, including one where also the payer could come into the scope of CDD if the payer uses the services of a PISP multiple times. To be clear, payers never get into the CDD scope of e.g. a card acquirer, independently of how many times they use such services or what amounts they pay.

2) Not discriminating PIS collection

Our second concern relates to the completely new proposed last sentence of Recital 34, which appears to be discriminating PIS against cards and all other payment types when combining it with collecting the payments on behalf of the payee, i.e. merchant.

In our view, Recital 34 should rather clarify that a collecting PSP has to perform its relevant CDD obligations, independent of whether the PSP provides PIS per se or not; in the case a PSP also provides PIS, the CDD obligation of the PSP is towards the merchant, both for the provision of PIS and the provision of payment collection, as was suggested by the Parliament.

Again, we are confident that this topic can be addressed on the technical level given that the current wording of the Recital is not aligned with the rest of the AML framework, which has a payment collecting PSP performing CDD on the payee/merchant, and appears outright discriminatory.

If the latest draft compromise text for recital 34 becomes law, we would see extreme detriment for PIS, Europe’s home-grown payment solution. As such, ETPPA, EMA, EPIF, EFA and OFA call on the European co-legislators to ensure in AMLR technical trilogues that Recital 34 of the AML Regulation makes it 100% clear that merchant-facing PISPs should perform CDD on the payee only, both in terms of the establishment of a customer relationship and for occasional transactions, and no matter whether they touch payee (merchant) funds or not.

To find out more please see here ETPPA’s summary position paper on the AML regulation, here for EMA’s response to the Commission’s draft AMLR, and here for EPIF’s response to the Commission’s AML package, and here for EFA’s position paper on the AML package.

ETPPA – European Third Party Providers Association (www.etppa.org)

EMA – Electronic Money Association (www.e-ma.org)

EPIF – European Payment Institutions Federation (www.paymentinstitutions.eu)

EFA – European Fintech Association (www.eufintechs.com)

OFA – Open Finance Association (www.openfinanceassociation.org)